Impact on Enterprises and People

As part of our mission to grow the amount of money tackling social issues in the UK, we aim to help build an investment ecosystem that supports impact-led organisations to address a range of social issues and reduce inequalities in the UK.

-

+3,750

organisations have received social investment from Better Society Capital since 2012

- increase of 7% from 2023

72%

of enterprises taking on investment are targeting disadvantaged and/or underserved groups of people

- decrease of 3% from 2023

64%

of organisations that have received investment are located within the most deprived areas of the UK

- increase of 4% from 2023

Impact on People

We collect the data points below on our fund managers’ investments, to track and communicate the impact on the enterprises taking on social investment and the people benefitting. While we don't collect “number of people reached” consistently across our entire portfolio, we know from fund managers’ impact reports that our investments help create important outcome changes for large numbers of people.

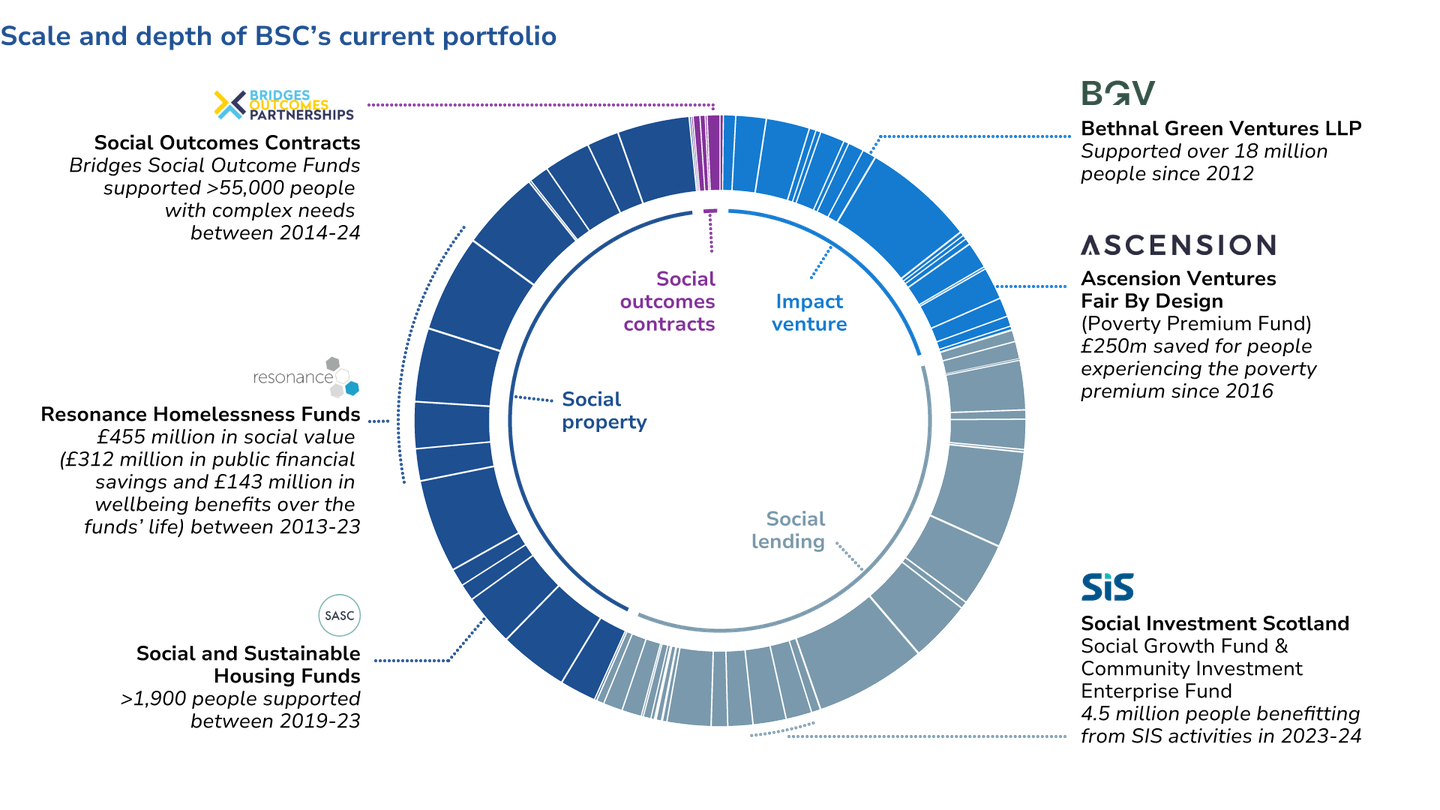

The visual below is intended to provide some illustrative examples of the scale and depth of this impact.

Primary SDGs across our portfolio

We continue to monitor the alignment of our fund managers’ investments with the Sustainable Development Goals (SDGs) to deepen our understanding of how our market-building efforts contribute to addressing social issues in the UK.

-

32%

sustainable cities and communities

22%

good health and wellbeing

18%

affordable and clean energy

Since 2023, we have seen an increase in investment targeted towards SDG one (No Poverty), which increased to 7% of the portfolio, an increase of 5% from 2023 and SDG ten (Reduced Inequalities) increased to 5% this year, an increase of 1% from 2023.

This content is not visible because you have denied third-party cookies. Update your cookie settings and refresh the page to interact with this element.

Case Study:

Handcrafted

An example of one of our investments focussed on SDG 11 (Sustainable Cities and Communities) includes Handcrafted which received investment through the Social and Sustainable Capital’s SASH fund.

Handcrafted is a charity based in Durham, Gateshead and Chester-le-Street which provides supported accommodation, alongside skills training to empower people to turn their own lives around. It has expertise working with young people with complex needs and those coming out of prison, care or other secure settings.

Outcome Areas and User Groups

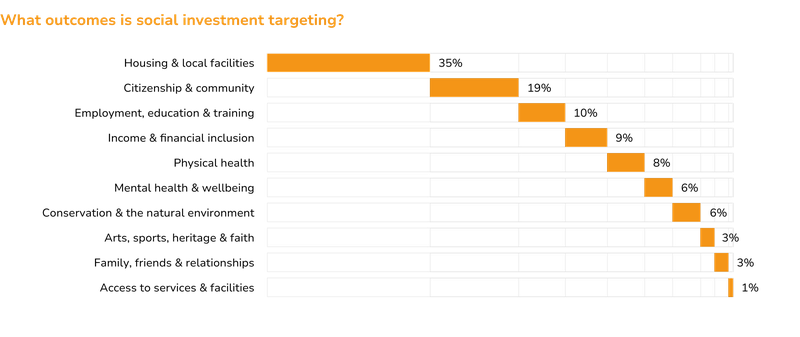

We continue to deploy our investment across a range of social issues, or outcome areas, supporting a wide range of end-users.

By tagging our portfolio by both outcome areas as identified in the Outcomes Matrix and user groups, we gain valuable insights into the social challenges we aim to address and the specific populations we target.

-

35%

of investment targeting housing and local facilities

- top outcome area by £ invested (stable from 2023).

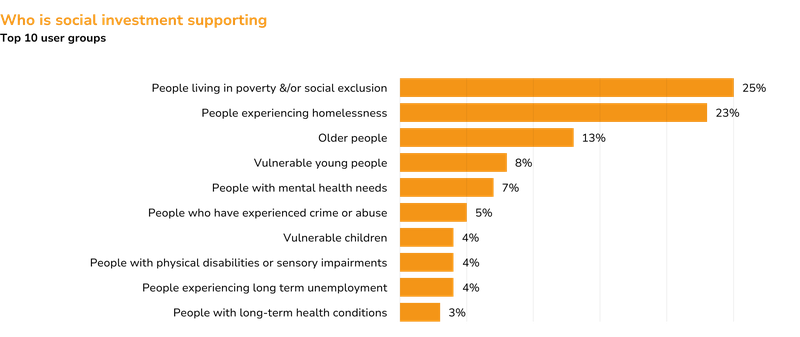

26%

of investment targeting people living in poverty and/or financial inclusion

- top user group by £ invested (decrease of 3% from 2023).

16%

of organisations taking on investment are supporting vulnerable young people

- Second user group by number of organisations (increase of 1% from 2023)

Business Models

28% of organisations that have received investment from BSC (to date) have adopted business models which drive revenue from the sale of products and services to the general population, opposed to targeting specific groups of disadvantaged people. This can be the case for broader social infrastructure investments, such as sports centres, or investments in tech companies that require the potential for large scale impact to attract investment. While many of these investments will still benefit disadvantaged populations, we have excluded this 28% from the chart above.

What outcomes are social investment targeting?

Who is social investment supporting?

Case study

Switchee

An example of one of our investments supporting people living in poverty or being financial excluded is Switchee which received investment through Ascension Ventures Fair by Design Fund.

Switchee is improving the quality of life for social housing residents by providing a smart thermostat tailored specifically for social housing providers. Unlike mainstream smart thermostats that require Wi-Fi, Switchee’s devices operate independently, making them accessible to the 4.1 million UK adults living in social housing without internet access.

Impact on Enterprises

In 2024, we are reporting a 7% increase in the number of enterprises reached to more than 3,7502.[1]

This increase is mainly driven by our social lending portfolio, particularly the increased number of loans made to social purpose organisations through the equity investments we make into social banks. There has also been an increase in loans made to SMEs in deprived areas through the Community Investment Enterprise Fund. We have also seen an increase in the number of organisations using social investment in our blended and debt fund lending portfolio. Of those named organisations, vulnerable young people and children are the top end-user groups. Supported by enterprises delivering outcomes across employment, education and training, family friends and relationships and citizenship and community.

Strengthening enterprise resilience and growth through our fund managers’ and social banks’ investments continues to form an important part of our investment objectives. This year, we have made progress in building out our enterprise level impact framework, with the aim of supporting organisations to scale their reach and improve their long-term sustainability.

Spotlight: Enterprise Level Impact Framework

The Enterprise level impact framework focuses on why organisations with our social lending portfolio take on investment (purpose) and how they use the proceeds. It then seeks to understand how this investment leads to two types of enterprise-level impacts: organisational resilience and growth through survey data and by measuring financial change.

Geographical Reach

-

+3,750

organisations have received social investment from Better Society Capital since 2012

- increase of 7% from 2023

70%

of social investment committed outside of London [3]

- stable from 2023

64%

of organisations that have received investment are located within the most deprived areas of the UK

- increase of 1% from 2023

We have invested in over 3,750 enterprises to date and the map below shows a selection that have received investment through the fund managers we work with and have shared their postcode data with us.

This content is not visible because you have denied third-party cookies. Update your cookie settings and refresh the page to interact with this element.

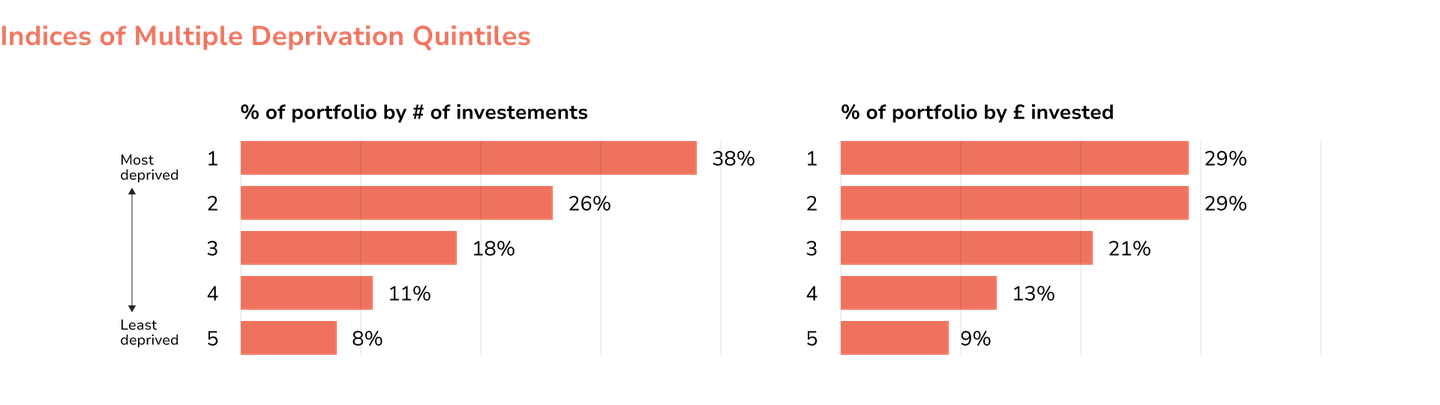

We map these investments by local authority and use the index of multiple deprivation (IMD) [4] to assess the relative deprivation of places where the organisations that have taken on social investment are based. This data can be reviewed by the number of investments or by the total value of those investments.

Case Study

Bradford Trident

Bradford Trident is an example of an organisation located in the lowest IMD quintile that received investment through the Recovery and Resilience Loan Fund managed by Social Investment Business. Bradford Trident is the community anchor for Little Horton and Southern Bradford, offering a wide range of services that cater to the needs of the local community.

End notes

-

This is an estimate based on portfolio data we receive from fund managers and intermediaries – to read more about our methodology, see About the Data section

→ -

We use the 'Year Zero' reporting approach

→ -

Of those where we know the geographical location

→ -

The Index of Multiple Deprivation is provided at the Local Authority level as quintiles, where one = the most deprived 20% of local authorities by nation and five = the least deprived 20% of local authorities by nation. Deprivation at the Local Authority (LA) level is measured using the percentage of small areas (Local Super Output Areas - LSOAs) within a Local Authority which are in the top 20% most deprived small areas nationally.

There are four measures of multiple deprivation for each UK country: England, Northern Ireland, Scotland and Wales. Each of these measures combines slightly different indicators and subsequently an Index of Multiple Deprivation

→