- Over half of those under 45-years-old, and two-thirds of those under 25, chose investments tackling social rather than environmental challenges

- 18 to 24-year-olds most concerned with investing in areas making a positive social impact, specifically across health and well-being

- As people get older, they become more concerned with investing in environmental protection

29th March 2022, London – People, on average, will opt for investments tackling social over environmental challenges when given the choice, according to new research [1] from Big Society Capital, the UK’s leading social impact investor.

All respondents were invited to choose three options across a range of social and environmental causes regarding their investment preference. Yet more than half (57%) of all under 45-year-olds, and two-thirds (67%) of all under 25s in the survey chose social impact investments of different types rather than an environmentally motivated investment.

The survey of UK adults with at least one investment outside of their pension showed that age does impact motivations toward responsible investments.

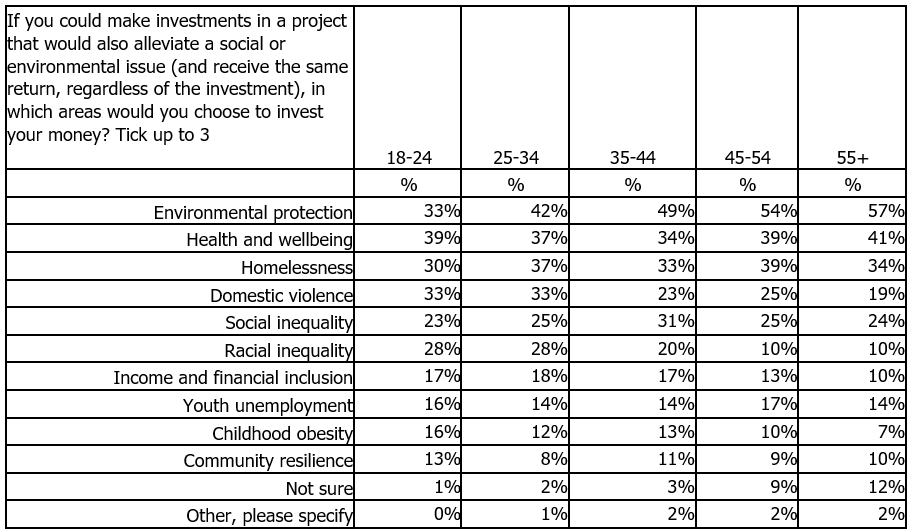

It reveals that those under the age of 25 prioritise investing in areas making a positive social impact. ‘Health and wellbeing’ attracted the most interest among the 18- to 24-year-olds, with almost four out of ten (39%) saying they would choose to invest their money in this area, for example a mental health charity, before environmental protection (selected by 33%).

The findings demonstrate that as people grow older, they seem to become more concerned with investing in environmental protection. For 25-year-olds and over, green issues top the list of preferred impact investment areas with the proportion of people selecting this increasing as they get older. For example, 42% of 25 to 34-year-olds would want to invest in environmental protection compared to considerably more, 57%, for the over 55s.

James Westhead, Head of Engagement at Big Society Capital said: “It may be a surprise to many that younger people, the future generations that will most feel the impact of climate change, have a discernible interested in using their capital to support people in society.

The interest in social impact investing is really encouraging as it has a huge role to play in supporting charities and social enterprises that provide essential services across the country, as well as contributing to the levelling up of the economy. Now is the time to capitalise on the huge social benefits that social impact investing can bring.”

Looking at all investors together, when considering how to invest their money to make a positive impact, while receiving the same return, environmental protection was top of the list, chosen by almost half, 48%. Homelessness, domestic violence, social inequality, and racial justice were also important factors influencing investment decisions for those wanting to make an impact.

Notes to Editor

[1] This survey was conducted by Censuswide on behalf of Big Society Capital between 10th January and 14th January 2022 among 2000 UK adults (18+) who have at least one investment outside their pension. Censuswide complies with the MRS Code of Conduct and ESOMAR principles.

James Westhead, Head of Engagement, is available for interview on request.

Press contact: Caroline Hailstone, chailstone@bigsocietycapital.com

About Big Society Capital

Big Society Capital exists to improve the lives of people in the UK through social impact investing. We unite ideas, expertise, and capital to create investment solutions for the UK’s social challenges, supporting organisations that deliver both positive social impact and sustainable financial returns. So far, we have helped channel £2.5 billion* into investments tackling a wide range of problems such as homelessness, mental ill health, and childhood obesity.

To widen access to social impact investing, we have partnered with Schroders, a global asset and wealth manager, to launch the listed Schroder BSC Social Impact Trust plc. As the portfolio manager, we provide investors with high impact investments that contribute to solutions to social challenges alongside targeting long-term capital growth and income.

Further information about Big Society Capital can be found at www.bigsocietycapital.com

*As at September 2021