Key stats

-

number of organisations that have received social investment from Better Society Capital since 2012

-

of organisations that have received investment are located within the most deprived areas of the UK

-

of social investment committed outside of London [1]

Our approach

Our investing and market-building work is underpinned by a robust approach to impact management/ measurement, and systems practice.

We are committed to supporting the fund managers and social banks we invest in. From helping to develop impact practice, to ensuring our partners play an active part in advancing impact and systems practice across the global impact investing community.

In alignment with our mandate and theory of change, we consider BSC’s contributions to impact and impact risks across two dimensions:

Systems Change: the change we intend to contribute to across the investment ecosystem. This includes investment and market building activities in collaboration with fund managers, intermediaries, enterprises, investors and the policy environment. Find out more about our progress against systems change in our 2024 Impact report.

Impact on People: The intended social impact and outcomes for people and communities that are served by the organisations and business models receiving investment through our fund managers and other intermediaries. Find out more about our latest impact data in our 2024 impact report.

We consider both, the impact on people and broader systems change throughout the investment life cycle, as well as within our broader market-building practice. ESG is similarly embedded throughout our investment process, for more detail please read about our ESG approach.

We acknowledge that a change in people’s outcomes is the impact that enterprises and charities directly contribute to. We contribute to such outcomes through our capital, as well as broader non-investment activities. We consider both as BSC’s “investor contribution”.

-

Managing impact along the investment cycle

Impact is firmly embedded along the entire investment cycle, from setting investments strategies, making and managing investments, to existing and learning from them. Find out more about our impact management approach and its alignment with the Operating Principles for Impact Management.

Learn more -

Systems practice

We consider robust impact practice an essential part of ensuring actual impact is being achieved and impact risks are being managed. This is true for us, as it is true for the fund managers we invest in.

Learn more -

Business models

We consider business models as the ways that organisations generate social impact (impact model) and create value and revenues (revenue model). Understanding the range of business model groups suitable for social investment provides important insights.

Learn more

Our ESG approach

Our approach is guided by three core principles:

- Proportionality: The rigour and scope of our ESG approach is proportionate to the nature and level of the risk being addressed.

- Credibility: In order to fulfil our responsibilities to stakeholders, our approach must not only be robust, it must be seen to be robust, and should therefore stand up to external scrutiny.

- Usefulness: Our ESG approach must deliver on its stated aim to identify and mitigate risks, and thereby improving our investment decision-making.

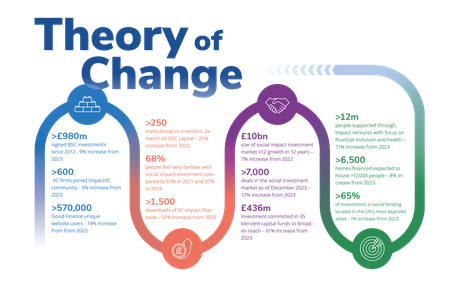

Our Theory of Change

We aim to build an enabling environment for more investment to flow to impact-led organisations. Our Theory of Change illustrates how our activities are expected to address barriers that unlock more capital from asset owners. As a result, we expect more organisations to be able to address social issues amongst disadvantaged and underserved communities.

Our activities are aimed towards building the market for social impact investment. Firstly, by investing across a broad range of private market asset classes in fund managers, social banks and other intermediaries. Secondly, we aim to influence existing stakeholders, including fund managers, investors, enterprises and policymakers, via awareness-raising activities and community-building efforts, as well as the development of impact investing standards, tools and resources.

These activities help to address the required changes across key stakeholders and market infrastructure, ultimately leading to more investment flowing to social enterprises, charities and other impact-led organisations. As a result of taking on investment, these organisations can grow or sustain their impact across the UK’s social issues, with a focus on disadvantaged people and under-served areas and communities.

Activities

We invest ourselves and build the market to scale social impact investment.

- Catalytic investing: seed, scale and sustain investments

- Market-building: stakeholder engagement, developing resources and supporting new initiatives

- >£980m signed BSC investments since 2012 – 9% increase from 2023

- >600 VC firms joined Impact VC community – 5% increase from 2023

- >570,000 Good Finance unique website users – 14% increase from 2023

Outputs

An enabling environment for more social impact investment.

- Asset owner’s capital facilitated into social investment

- Increased awareness and understanding of social impact investment

- Change in resources, policies and practices

- >250 institutional co-investors, 3x match on BSC capital – 25% increase from 2023

- 68% people feel very familiar with social impact investment compared to 65% in 2021 and 37% in 2018

- >1,500 downloads of VC Impact Playbook - 50% increase from 2023

Outcomes

More investment flowing into impact-led organisations.

- Increased scale of capital to tackle significant social issues

- Increased number and diversity of organisations addressing social investment

- Broader range of business models reached through blended capital

- >£10bn size of social impact investment market x12 growth in 12 years – 7% increase from 2022

- >7000 deals in the social investment marker as of December 2023 – 17% increase from 2023

- £436m investment committed in 35 blended capital funds to broaden reach – 61% increase from 2023

Impact

More social impact across a range of pressing social issues and reducing inequalities in the UK.

- Delivering impact at scale

- Achieving important outcome changes for vulnerable people

- Reaching disadvantaged communities

- >12m people supported through impact ventures with focus on financial inclusion and health – 71% increase from 2023

- >6500 homes financed expected to house >17,000 people – 8% increase from 2023

- 65% of investments in social lending located in the UK’s most deprived areas - %1 increase from 2023

Impact report 2024

We want to be clearer and more transparent about the impact we intend to achieve, and the progress we are making towards it. Our latest impact report highlights what we are learning across our market building and investing work, and what we think good impact and impact practice looks like across these areas. Find previous impact reports on our key documents page.

[1] - Of those where we know the geographical location

Impact team

If you want to learn more about how we measure impact, or to find out how you can measure impact in your organisation, get in touch.