"We have a self-defeating capitalist system where social and environmental problems get bigger and bigger. If Adam Smith could have envisaged measuring impact, he might have said that impact is the invisible heart of the market to guide the invisible hand." [1] Sir Ronald Cohen

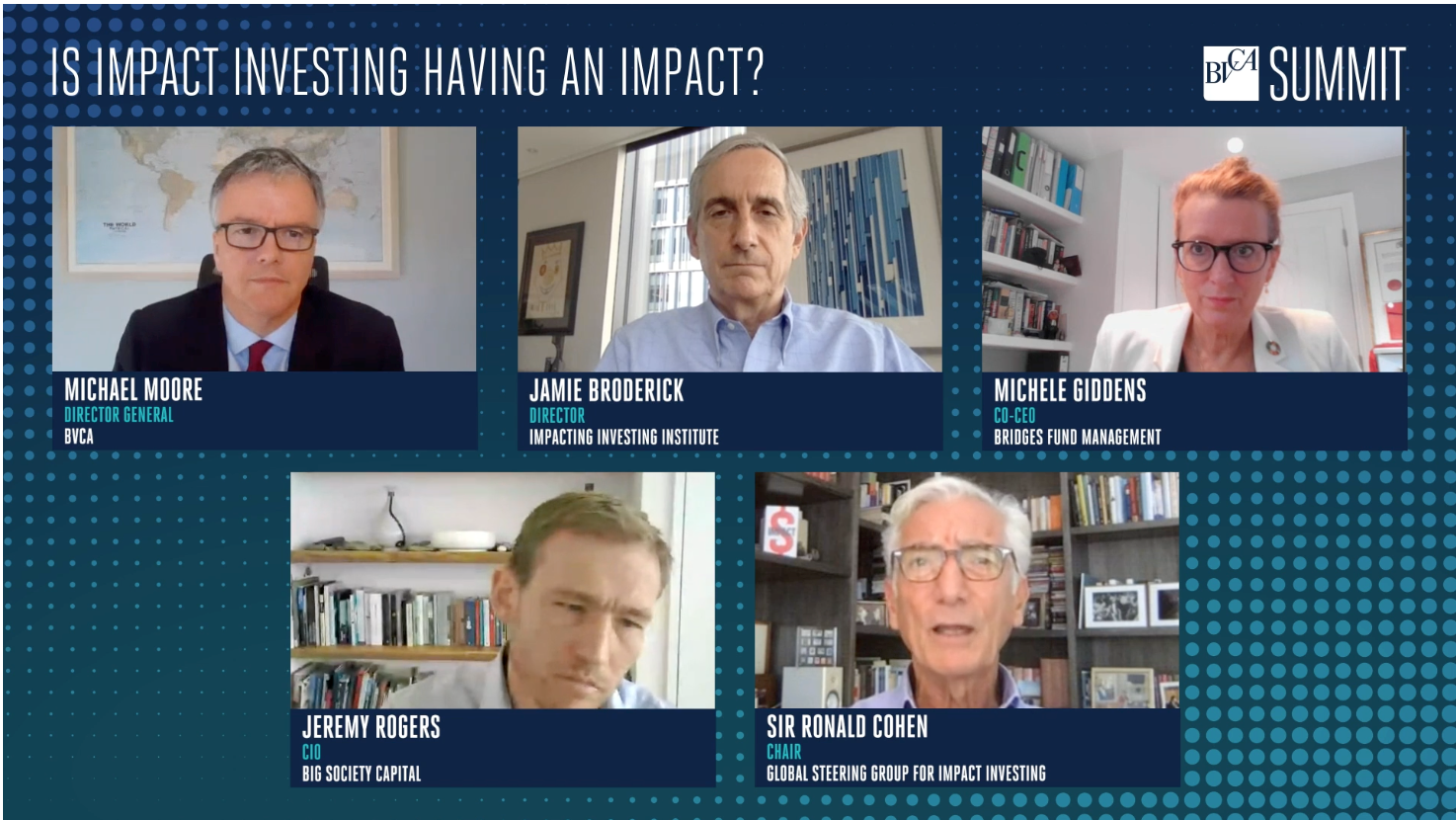

Last week, I joined colleagues from the impact investing community for a panel discussion at the British Private Equity & Venture Capital Association (BVCA) Summit, New Horizons to tackle the question: ‘Is impact investing having an impact?’.

In this blog, I share some of the highlights from our discussion where we conclude that impact investing is having a big impact across the investment ecosystem, going far beyond Big Society Capital’s work with mission driven organisations in the UK. Asset owners increasingly want to see their managers assess for social and environmental impact and impact intent. Entrepreneurs and businesses want to work with managers who are aligned with the concept of doing well by doing good. The panel concluded that the coronavirus pandemic and climate change crisis mean these trends are set to accelerate.

Is the ‘impact revolution’ close to a ‘tipping point’ or already in the ‘mainstream’?

Some of the early forces driving change were young people’s consumption habits and where they chose to work – as well as entrepreneurs establishing new impact driven businesses. Increasingly, we see asset owners as the agents of change through pressure on their investment managers. There are now over $30 trillion of assets managed for impact principles, including the consideration of Environmental, Social and Governance (ESG) factors – or around a third of actively managed assets.

We are seeing a shift further into targeted impact objectives being led by mission driven investors such as endowments, but with pension funds increasingly active – with many exploring specific 5-10% allocations to impact. In the UK, the Impact Investing Institute has recently published five principles for pension trustees as they consider the transition to targeting impact.

At Big Society Capital, we see the scale of this shift across our activities - from our work with asset owners to the number of new fund applications we receive. For example, in social impact venture we have received over 75 new venture fund applications already this year, in comparison to less than 10 in 2018.

We see increasing interest from all types of investors in how considering impact can add value to their investments. Perhaps the best evidence we are reaching the mainstream is when truly assessing social and environmental impact just becomes part of good investing.

How close are we to consensus on the ‘measurement’ challenge?

A central challenge surrounding impact investing is consensus on impact measurement. Whilst consensus is still a little way off, huge strides have been made by pioneering organisations such as the Impact Management Project to develop and integrate consistent frameworks.

We discussed recent initiatives such as the Impact Weighted Accounts project at Harvard Business School and how technology and big data are helping enable greater impact transparency. The consensus of the panel was that regulation was going to be an increasing force to drive impact transparency further into private companies – with significant change expected in the next few years. This has the potential to have a significant effect on company valuations with some evidence this is already taking place.

Does COVID-19 blunt the revolution or fan it?

The coronavirus pandemic has been both a health and a social economic crisis and has heightened people’s awareness of social issues. It has helped re-balance the focus across environmental and social issues. Panellists highlighted that ‘Building back better’ is all about resilience and prevention. Investment practices have to change to help reduce the likelihood of future shocks and increase society’s resilience to them when they do occur. Although these preventative measures may be more expensive in the short term, COVID-19 is clearly sending us a message that it will deliver cost savings in the long term. And businesses that have been adopting this approach for a number of years are those that have stood up best financially.

To conclude

Impact investing is already changing the investment ecosystem. Investors are increasingly seeing impact as a source of value in considering all investments. Asset owners are increasingly allocating capital to those funds who invest intentionality to exert a positive impact; are delivering additionality beyond the provision of private capital; and, commit to ongoing measurement and management of impact performance.