In our ‘Meet the Impact Manager’ guest blog series, we hear how some fund managers in our portfolio have been responding to COVID-19. This week, Camilla Dolan, Partner at Eka Ventures, shares how they approach impact investing and how COVID-19 has accelerated the growth of consumer technology companies with strong ‘shared value’.

Eka Ventures invests in founders creating consumer technology companies with the potential to build shareholder value in parallel with societal value, we call this ‘shared value’.

We invest £1 - 3 million per company at Pre-A and Series A (companies that have early product market fit) in the UK.

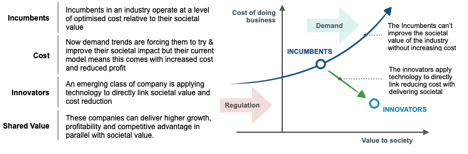

Our approach to impact investing has developed through over twenty years of combined venture experience and the observation that there are two mega trends at play, creating an unprecedented value opportunity for impact investors:

- Demand

People increasingly care about where they spend their money (customers), where they earn their money (talent) and where they invest their money (capital). Customers, talent and capital are the three drivers of shareholder value in any company. This trend is mainstream, spanning geographies, income levels and age demographics. However, customers will not compromise on price, talent will not compromise on income and capital will not compromise on returns, and that is where trend two comes from… - Technology

The leading consumer technology businesses of today are integrated into the physical world. They are applying digital technology, mechanical engineering and material science across the supply chain. Data is the glue that runs through these businesses and enables them to deliver products and services in a way that was not previously possible whilst driving down the cost at the same time. This is particularly apparent in healthcare where effective solutions are often required to combine testing with the input of a healthcare practitioner and ongoing monitoring.

Founders who tap into these two trends have the potential to build companies that have a significant competitive advantage. They will be the industry-changing companies of the next 20 years. These are the founders that we set Eka up to back.

On a personal level, I became interested in the concept of shared value whilst employed at Bain during the financial crisis, where I worked with several retail banks restructuring their mortgage books, and saw first-hand the devastating consequences on individuals that can arise from a system that is based on profitability at any cost. Over the past seven years that I have been a venture investor, I have been fortunate enough to see the power a shared value approach has in helping to attract and retain talent, a core lifeblood of any business. For example, Elder, an elderly care platform I led the Series A for, have been able to hire and retain top talent from the very start of their business.

One of the biggest changes that we have seen as a result of the COVID-19 crisis is that consumer technology companies with strong shared value traits have seen rapid acceleration in their growth. COVID-19 has led to a forced adoption of digitally enabled services in segments that have been slow to benefit from the power of technology. For example, there has been a shift towards NHS services from GP check ins, to mental health delivery and diagnostics being delivered remotely using online technology platforms. In food, online sales have increased to 9% in April up from 5% in 2019. Business models that are targeting the vulnerable and hard to access have benefitted particularly strongly, for example, services that help the elderly stay in the home such as food boxes, care services and technology enabled monitoring.

COVID-19 has re-enforced Eka’s belief that the most important determinant of an early stage business’s success is the quality of the founding team. The teams with the strongest founders, even in sectors that on the face of it have been challenged by COVID-19, have found ways to iterate their models to fit the evolving landscape. It has been inspiring to see the resilience and creativity that we have witnessed from some of the founders that we have worked with during the COVID-19 period.

We see impact investment becoming increasingly mainstream as all stakeholders (customers, talent, shareholders, acquirers) recognise the power of having a shared impactful mission and the potential it has to generate sustained, strong commercial returns. Our hypothesis is that there will be increased opportunities across sectors, including:

- Healthcare and care services delivered in a consumer setting from diagnosis, to treatment to monitoring.

- A new breed of financial services companies that help individuals and households more effectively achieve financial security, including new alternative insurance models that are focused on segments that have traditionally been under-served by incumbents

- Food and grocery innovation stimulated by the increased adoption of online grocery purchase and the need to innovate in the supply chain.

- The rise of local networks that facilitate higher engagement within communities as individuals’ centre of gravity shifts from at work interactions to in the community interactions.

Big Society Capital’s knowledge and resource around best in class impact metrics has been invaluable in developing Eka’s approach to impact assessment both during due diligence and portfolio monitoring. We have worked closely with Dougie and Nick in the team on this and continue to pick their brains on a regular basis!

The leading social impact-led investor has played an instrumental role in Eka’s first investment into Urban Jungle, a fast growth technology company on a mission to create a fairer insurance product for renters. We believe this is a great example of a company with shared value potential and we look forward to working closely with the team to bring impact intent to venture investing.

If you are interested in finding out more about Eka, please get in touch camilla@ekavc.com