We start with the social issue

Our approach to making investments starts with the social issue, identifying enterprise solutions to social problems where investment could play a role. We then consider investments’ risk and return against three criteria.

-

Impact on people

We aim to improve the lives of vulnerable and disadvantaged people in the UK.

-

Impact on the system

We aim to have an impact beyond our own investments, by changing systems to create a sustained positive impact.

-

Financial sustainability

We aim for investments that produce a sustainable return and can grow by attracting other investors.

Additional factors

We consider the following additional factors when we build our portfolio.

-

Opportunities and risks

We consider opportunities and risks against our long-term views on different enterprise models. We take greater risk when we see a big opportunity for long term impact or the potential to change the system.

-

Building a broad market

We aim to build a broad social impact investment market tackling many social challenges. We also aim for diversity across other factors including organisation type, geography and investment product type.

-

Attracting investors

We aim to bring in other investors alongside us to achieve a greater social impact. We do this by pricing investments at risk-adjusted levels where others will invest.

Bringing it all together

We aim to achieve this while meeting the targets we set on commitment, drawdown, repayments and financial return – these enable us to maintain the availability of investment and catalyse new areas over the long term. We aim to commit £75-100 million each year in to new high potential proposals, and have done this every year since 2013. These investments have helped grow the social impact investment market nearly ten-fold over ten years, from £830 million in 2011 to £7.9 billion in 2021.

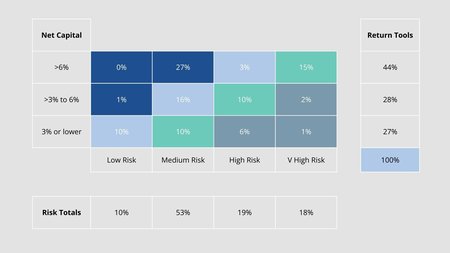

Portfolio risk/return zones

The table below maps our portfolio as at the end of Q3 2024 into risk/return zones. The vertical axis shows the return (expected net IRR at the time of investment approval) and the horizontal axis shows financial risk (dispersion of expected return).

You may also be interested in

-

Learn more

Learn moreAdding value to our managers

We take an active role after we make an investment to achieve impact.

-

Learn more

Learn morePortfolio

We make investments that create an impact on people, generate returns for investors, and change the system.

-

Learn more

Learn moreImpact

Our approach to impact is deeply embedded in our investment process, decision making and portfolio management, making sure it runs through everything we do.

Contact

If you'd like to learn more about how we construct our social impact investment portfolio, get in touch.